Emerging technologies like machine learning (ML) and artificial intelligence (AI) have the potential to transform the financial services sector completely. According to Allied Market Research, AI is predicted to grow from its $3.88 billion valuation in the banking sector in 2020 to an astounding $64.03 billion by 2030. Most uses of AI are related to managing and analysing credit risk.

The advent of ML and AI has given financial institutions access to previously unimaginable volumes of data, enabling more precise and timely determinations of creditworthiness. So, how crucial is AI for credit scoring and payment fraud detection in today’s financial landscape? Let’s find out.

The Evolution of Credit Scoring

Earlier, the conventional credit scoring models included only a handful of factors, including payment history, credit history duration, debt balances, and credit types. Nevertheless, these methods can include those with a conventional credit history, such as young adults or those living in underdeveloped nations.

Today, credit scoring based on AI, using ML, goes beyond just looking at a person’s credit history by analysing a wide variety of data using machine learning algorithms. For instance, financial institutions often employ AI algorithms to develop default potential and loss severity models. Together, these factors allow for more accurate credit predictions.

With this oversight, businesses and other institutions may maximise the returns from their loan portfolios and collection efforts. According to McKinsey, AI and other technologies can process structured and unstructured data, allowing for better credit risk management choices.

Advantages of AI-Driven Credit Scoring

Credit scoring is evolving due to clients’ increased digital footprints across the company’s digital properties and numerous social networks. Top lenders use ML credit scoring techniques such as support vector algorithms, random forests, ensemble training, and hybrid genetic methods for automatically setting the model and enhancing feature selection strategies

These methods help train rule-inferring prototypes based on structured and unstructured information from these footprints and third-party data sources. With an accuracy rate of over 99%, these programmes can replace human intervention in most situations, decreasing costs while increasing attrition.

With AI, the U.S.-based FinTech business ZestFinance demonstrated measurable improvements in credit risk optimization. The technique reduced on default and loss rates by 20%.

Automating Fraud Detection with AI and ML

Whether it’s a new fintech startup, a well-established bank, or an insurance provider, all must ensure they work with legitimate customers and not impostors to meet regulatory and compliance standards.

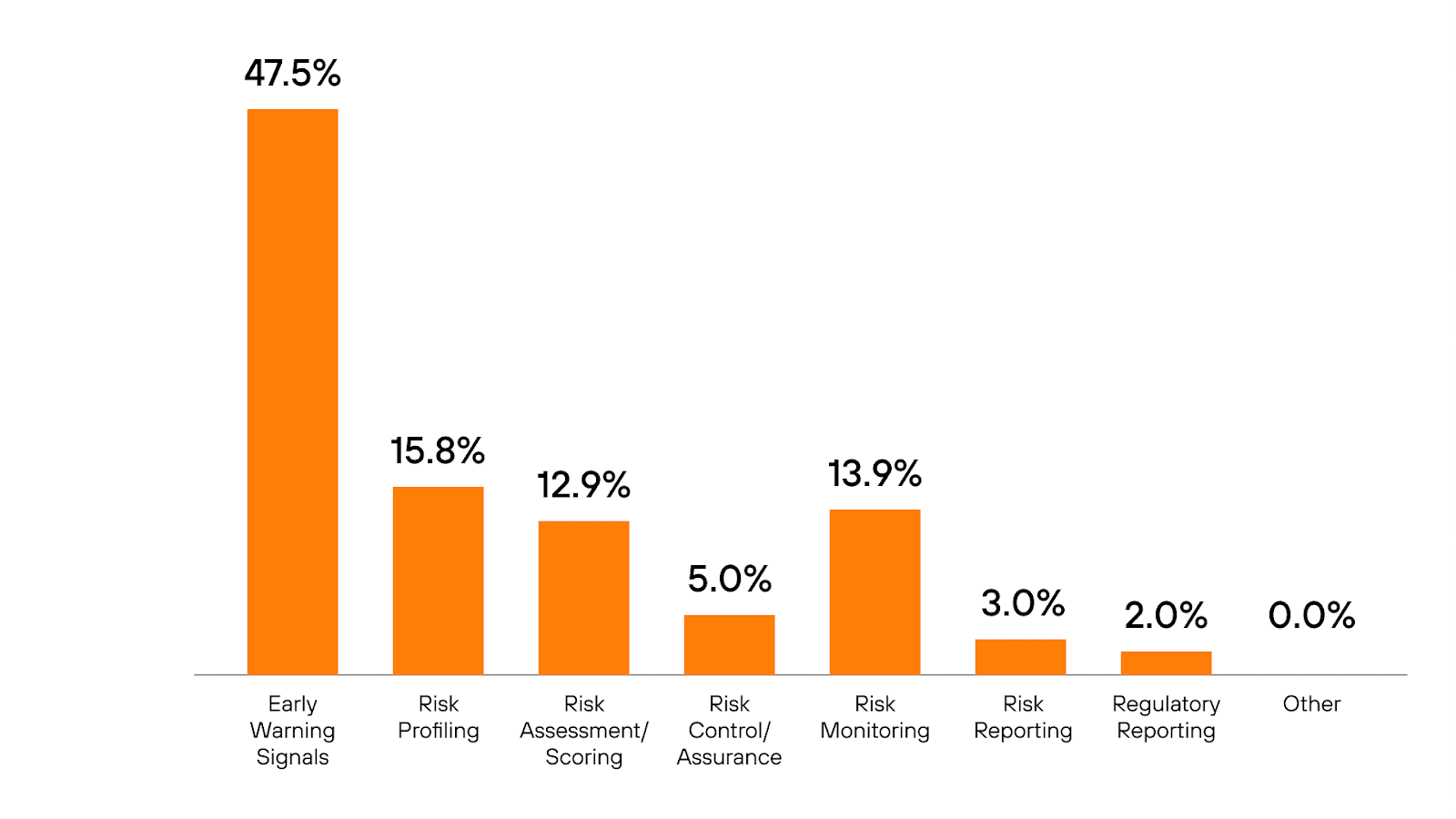

The more a bank can provide loans, the greater its vulnerability to fraud. Many organizations now use AI-powered technologies that can spot the first signs of fraud. The following illustration indicates the priorities of banks for AI based apps.

McKinsey uses Ping An as an example of a firm that uses image analytics to identify whether a loan applicant is telling the truth by analysing hundreds of facial microexpressions. This demonstrates how AI can analyse a variety of data inputs to improve business outcomes like customer acquisition and fraud prevention.

Since payment processors must handle thousands of transactions daily, having someone check each is impracticable. For example, you may train a machine learning engine to detect fraudulent transactions that might otherwise incur chargeback fees.

The Future of AI and ML in Credit Scoring and Fraud Detection

AI-based credit scoring systems are anticipated to become even more precise and comprehensive in evaluating credit risk as ML algorithms grow more advanced and resilient and alternative data sources become more freely accessible.

The integration of AI with edge capabilities is the most probable future scenario. In essence, edge computing harnesses the processing capacity of the device itself to provide near-real-time, in-depth insights and predictive analytics. By 2030, the edge computing industry, according to a study from Industry Research Future (MRFR), is expected to be worth $168.59 billion. In addition, there is a growing need for edge computing.

There is a rising trend towards using AI and ML in financial services. This tendency is anticipated to continue and speed up in the future. Industry and regulatory agencies must continue to work together to ensure their responsible and ethical use.

Who we are

Arvog is a new-age, AI/ML-powered, customer-centric finance company that makes digital lending quick, efficient, and easy. We focus on digital personal loans and digital gold loans.